Introduction

AI technology is fundamentally reshaping the sales landscape within the finance sector, presenting innovative solutions that streamline processes and enhance efficiency. By integrating AI telemarketers, finance managers can reap significant benefits, including:

- Improved lead qualification

- Cost savings

- Personalized client interactions

However, as organizations embrace these advancements, they must navigate the complexities of implementation and compliance.

How can finance teams effectively leverage AI telemarketing to not only boost sales but also maintain a competitive edge in an ever-evolving market? This question is crucial as it underscores the need for strategic adaptation in a rapidly changing environment.

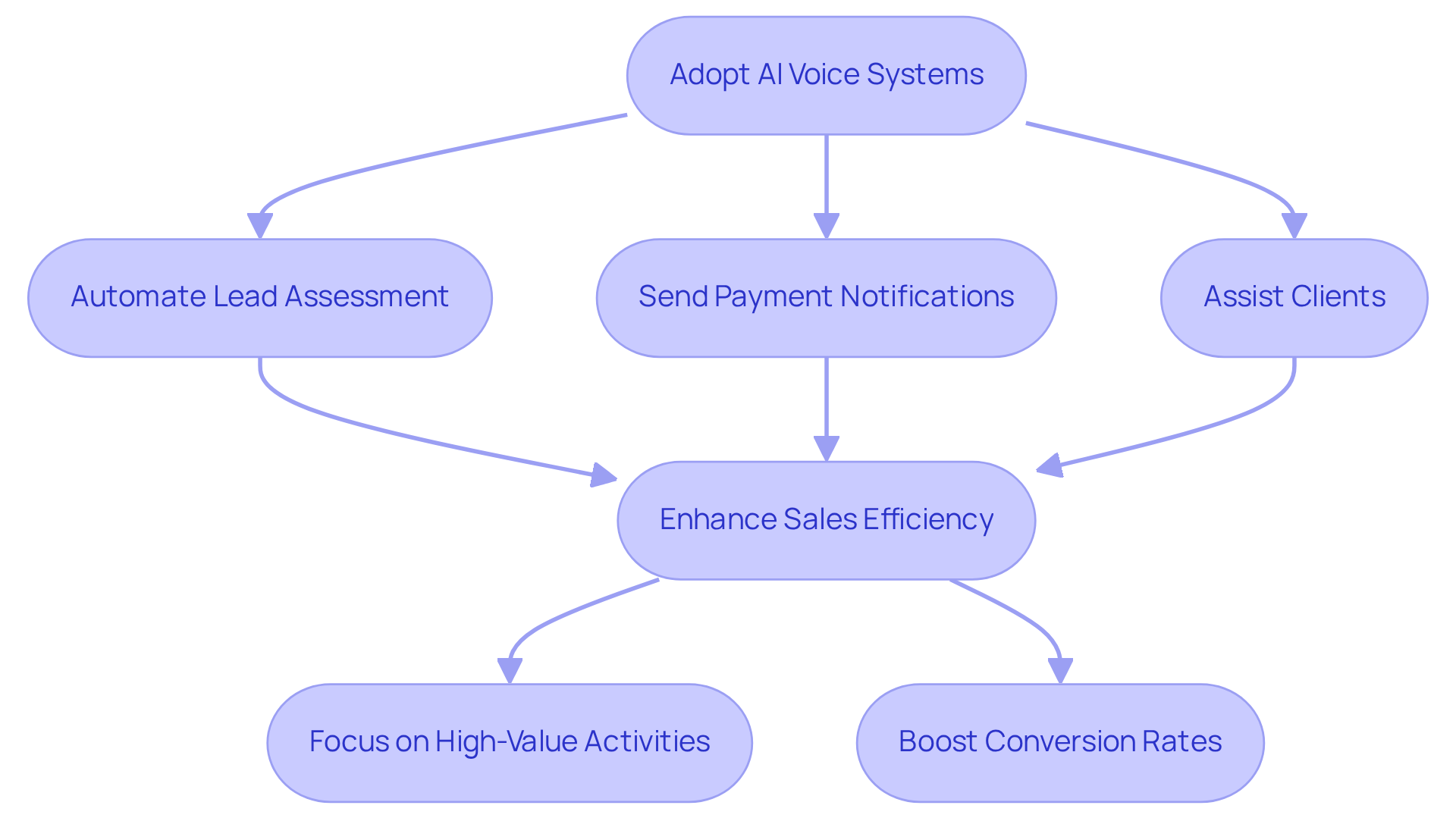

Intone: Enhance Sales Efficiency with AI Voice Agents

Intone's AI voice systems revolutionize sales workflows by automating lead assessment, payment notifications, and client assistance. This automation empowers managers to concentrate on high-value activities, enhancing sales efficiency while ensuring timely and relevant interactions-an essential factor in the fast-paced finance sector.

Tailored to meet specific business needs, these AI telemarketers facilitate more effective client interactions, ultimately boosting conversion rates. Companies that have integrated an AI telemarketer report significant improvements in lead qualification accuracy and customer satisfaction. For instance, an AI telemarketer can handle thousands of conversations simultaneously, far surpassing the capacity of human sales staff, who typically manage only 50 to 100 meaningful interactions per day. This capability is particularly beneficial in financial contexts, where prompt and precise communication is crucial.

As a result, financial professionals can save up to 30 percent of their time, allowing them to focus on strategic initiatives rather than routine tasks. The integration of AI into commercial processes not only streamlines operations but also positions finance teams to respond swiftly to market demands, thereby enhancing overall productivity and effectiveness.

In summary, adopting AI voice systems is not just a technological upgrade; it’s a strategic move that can transform how finance teams operate, ensuring they remain competitive and responsive in a rapidly evolving market.

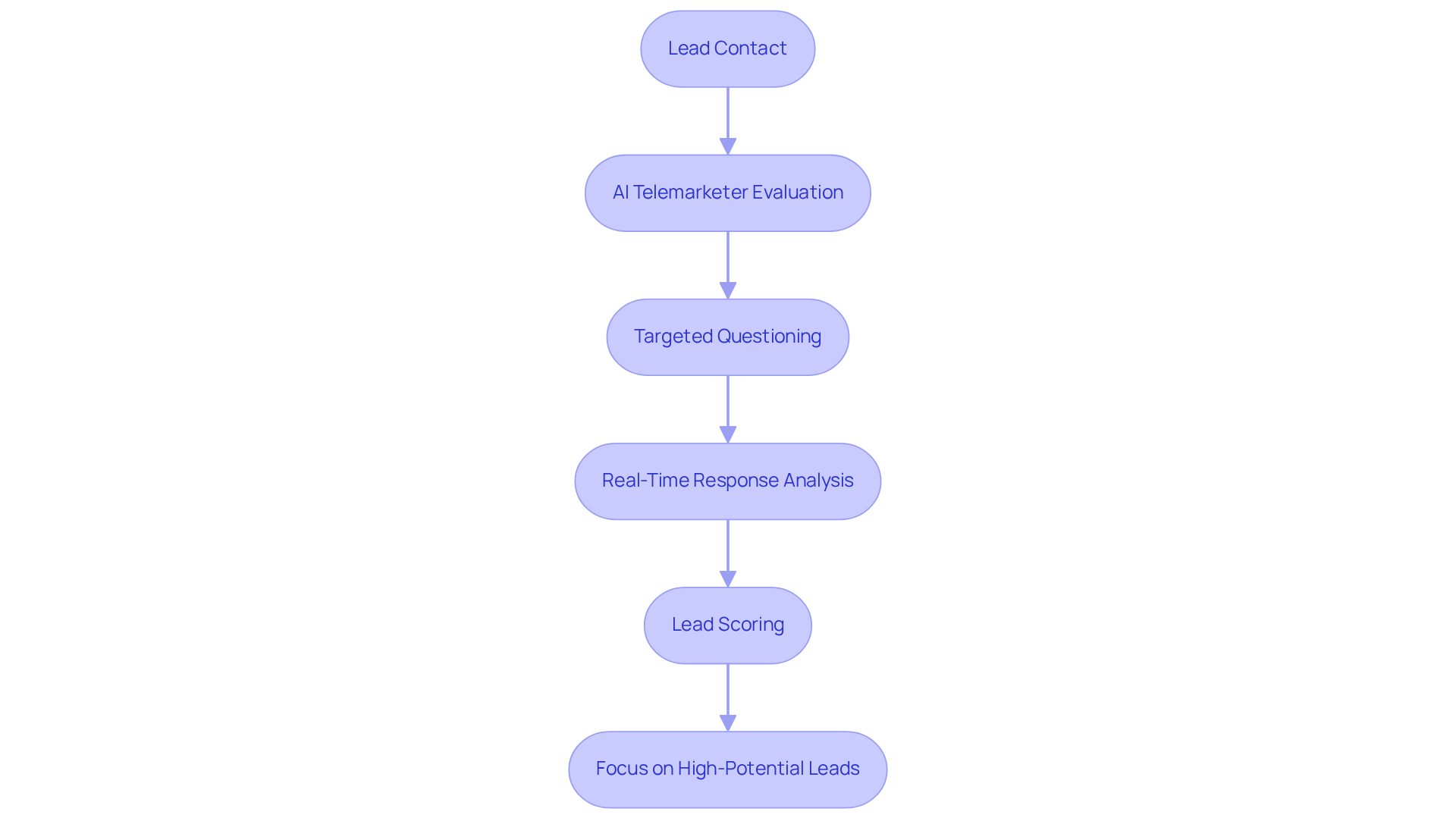

Lead Qualification: Streamline Your Sales Process with AI Telemarketers

AI telemarketers are transforming the lead qualification process by utilizing sophisticated algorithms to evaluate potential customers' interest and readiness to make a purchase. By employing targeted questioning and real-time response analysis, these systems effectively score leads based on their likelihood to convert. This automation not only optimizes the revenue process but also ensures that teams focus their efforts on leads with the highest potential, ultimately enhancing efficiency within the revenue funnel.

In the finance sector, automated lead scoring has proven particularly impactful. Organizations can swiftly identify high-intent prospects, significantly improving conversion rates. The incorporation of AI in lead scoring transforms conventional business strategies, enabling teams to operate with enhanced accuracy and understanding.

For instance, GCS successfully boosted its revenue efficiency by leveraging Intone's adaptable AI telemarketer voice assistants, which require no setup or adjustment. With just a script, GCS deployed an AI sales representative tailored to their specific needs, utilizing features like the editor for script uploads and intelligent analytics for tracking performance. This approach exemplifies how Intone's solutions can enhance sales and client engagement in the financial industry.

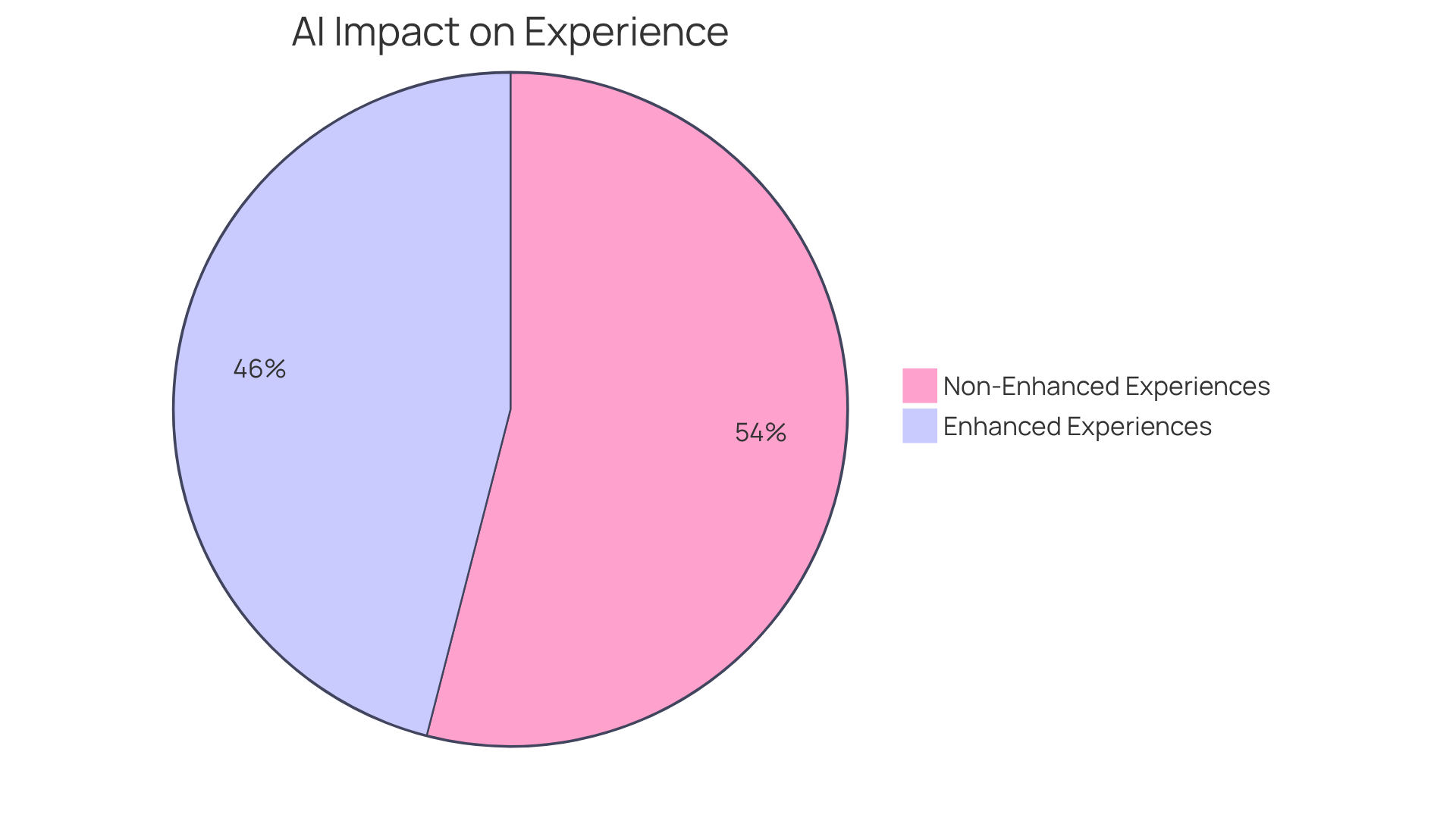

24/7 Availability: Ensure Constant Customer Engagement with AI Solutions

AI voice agents provide unparalleled 24/7 accessibility, ensuring inquiries are addressed at any time. This constant engagement empowers financial managers to connect with potential leads beyond traditional business hours, capturing opportunities that might otherwise slip away. Quick responses to inquiries not only boost client satisfaction but also foster reliability - an essential component in building trust within the finance sector.

As highlighted by industry leaders, maintaining continuous client support is crucial for success; in fact, 46% of financial institutions utilizing AI report enhanced client experiences. Companies like TD Bank have recognized the strategic advantage of offering around-the-clock AI support, enabling them to meet customer needs promptly and effectively. This capability not only enhances lead capture but also underscores the significance of being consistently available in the competitive financial landscape.

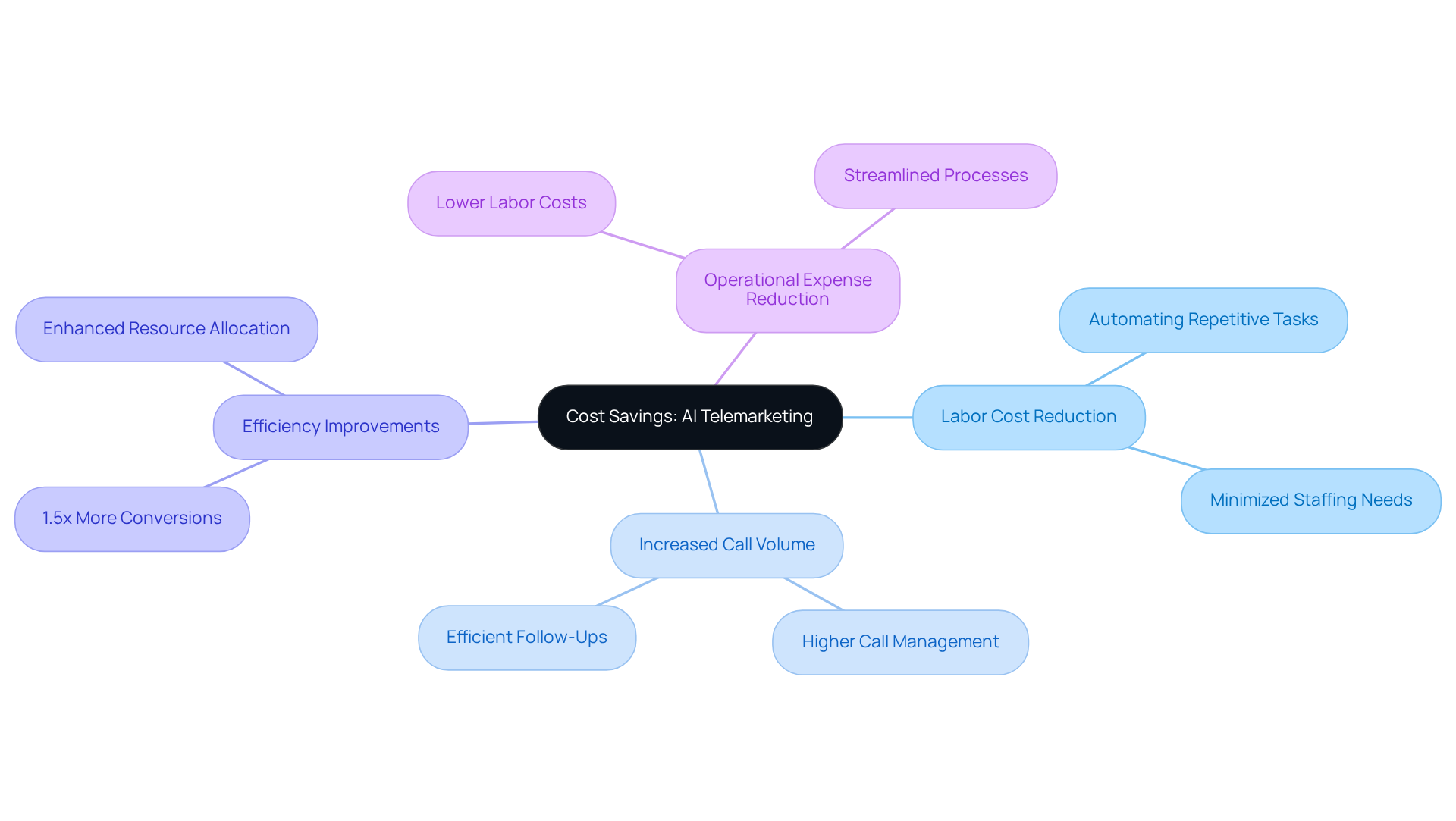

Cost Savings: Reduce Operational Expenses with AI Telemarketing

Incorporating an AI telemarketer can lead to substantial cost reductions for financial departments. By automating repetitive tasks like lead outreach and follow-ups, organizations can significantly lower labor costs and minimize the need for extensive staffing. AI telemarketers excel at managing a higher volume of calls than human agents, which not only drives down operational expenses but also ensures high service quality.

Consider this: companies leveraging AI have reported efficiency improvements, with some achieving up to 1.5 times more conversions compared to traditional methods. This enhanced efficiency empowers finance managers to allocate resources more strategically, ultimately boosting overall productivity. As a result, organizations can adeptly navigate the complexities of financial operations while optimizing their cost structures.

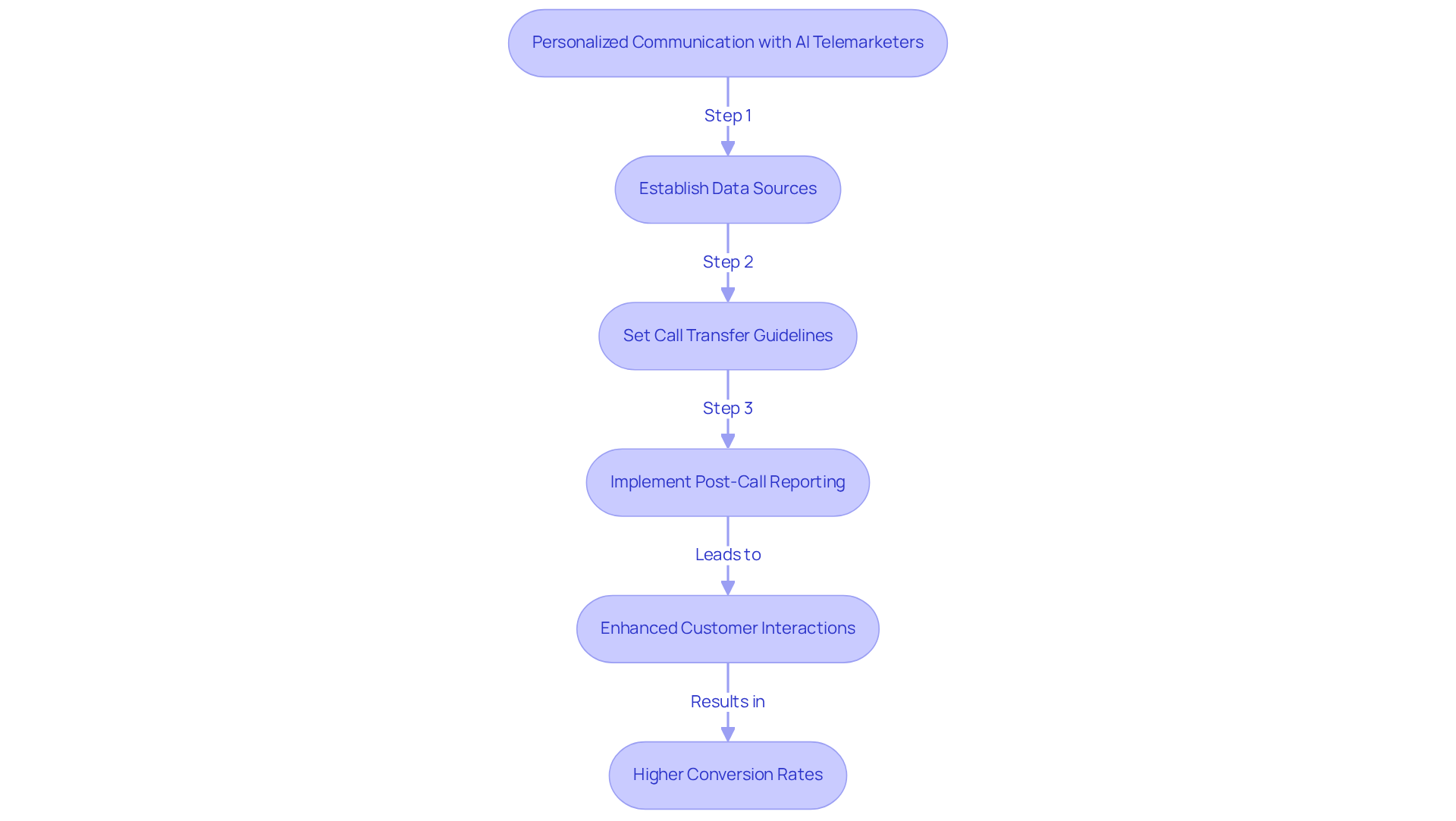

Personalized Communication: Boost Conversion Rates with AI Telemarketers

AI telemarketers are transforming customer interactions by tailoring their communication according to client data and preferences. This approach creates a more personalized experience that resonates with individual prospects. By analyzing previous interactions and buyer behavior, the AI telemarketer can customize their messaging to forge deeper connections.

Intone's AI agents take this a step further, allowing managers to customize campaigns effectively. They can:

- Establish specific data sources

- Set call transfer guidelines

- Implement post-call reporting

This level of personalization not only increases engagement but also significantly boosts conversion rates when used by an AI telemarketer. Customers are more likely to respond positively to tailored communications that an AI telemarketer uses to address their specific needs and concerns.

Moreover, with smart analytics, sales teams can refine their strategies even further. This ensures that every interaction is optimized for success, leading to improved outcomes. By leveraging these insights, organizations can enhance their telemarketing efforts, driving better results and fostering stronger relationships with clients.

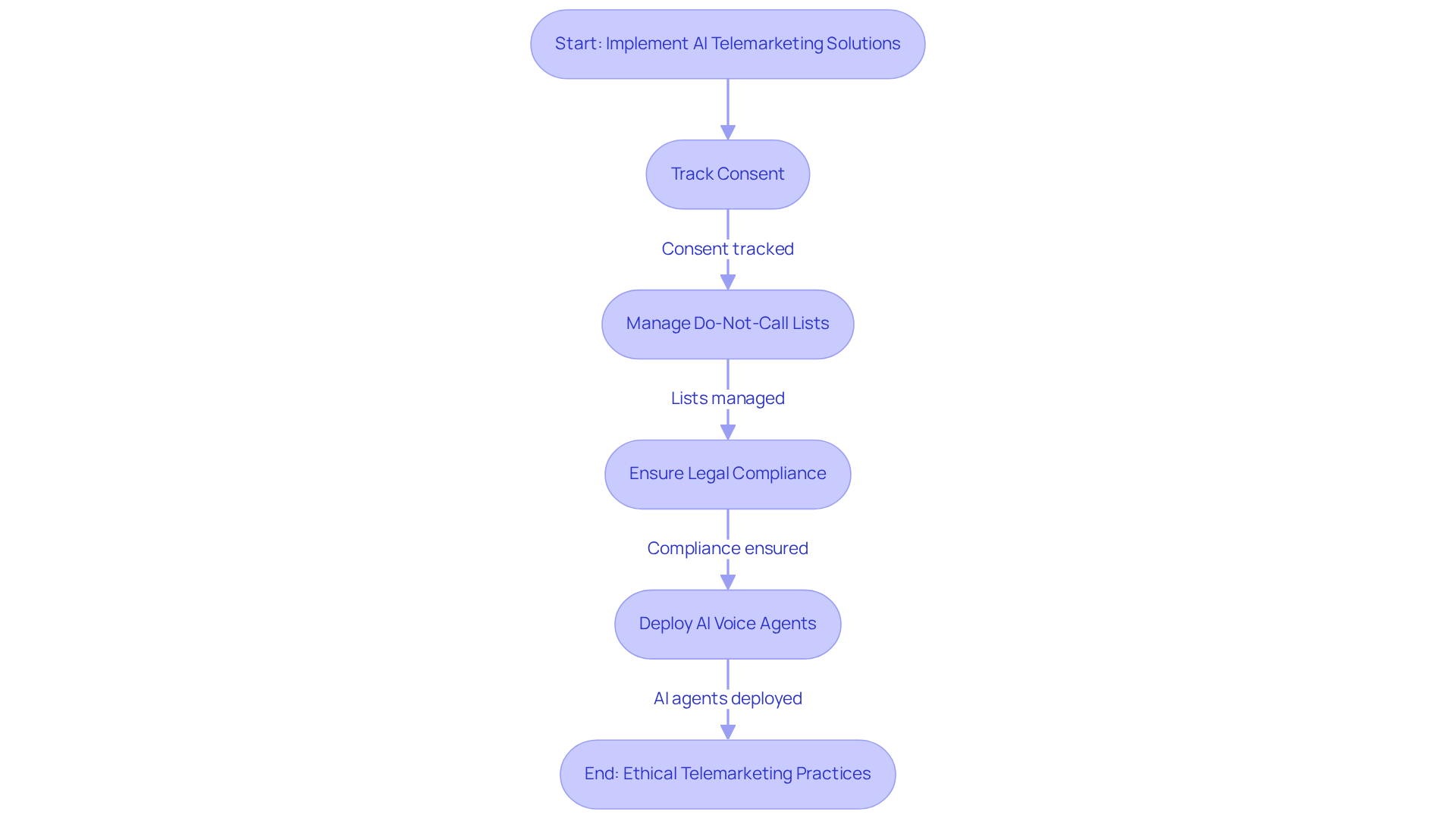

Regulatory Compliance: Navigate Legal Challenges with AI Telemarketing

Intone's AI telemarketer solutions are meticulously crafted to meet regulatory standards, including the Telephone Consumer Protection Act (TCPA). These advanced systems automatically track consent, manage do-not-call lists, and ensure that all communications adhere to legal requirements.

With Intone's rapid deployment capabilities, our dedicated team facilitates a seamless transition from script to live AI voice agents in just days, with a dedicated engineer guiding you through every step. This swift implementation not only enhances operational efficiency but also empowers financial managers to navigate the complexities of compliance with greater effectiveness.

By leveraging AI telemarketer technology, organizations can significantly reduce the risk of legal challenges, ensuring that their telemarketing practices remain both ethical and lawful. Intelligent checks integrated into each call flow prevent inaccuracies, enforce logical processes, and uphold compliance, thereby automating scalable outreach for improved sales efficiency.

Incorporating these AI telemarketer solutions not only streamlines operations but also establishes your business as a leader in ethical telemarketing practices. Embrace the future of telemarketing with Intone, where compliance and efficiency converge.

Real-Time Analytics: Optimize Sales Strategies with AI Insights

AI systems provide finance managers with real-time analytics, allowing them to monitor revenue performance and client interactions as they happen. This capability not only captures attention but also facilitates rapid adjustments to marketing strategies, enabling teams to respond effectively to market shifts and customer demands.

For instance, GCS achieved remarkable results by leveraging Intone's customizable AI telemarketer voice agents, which required no setup or tuning. By simply articulating their needs, GCS enhanced their processes, leading to a 25% increase in lead conversion rates. This case study exemplifies how actionable insights can drive significant improvements in performance.

Moreover, by analyzing data on lead interactions and conversion rates, budget managers can identify patterns that inform strategic enhancements. This proactive approach ultimately leads to improved outcomes and a boost in overall revenue performance. Embracing AI-driven insights is not just a trend; it’s a necessity for finance professionals aiming to stay ahead in a competitive landscape.

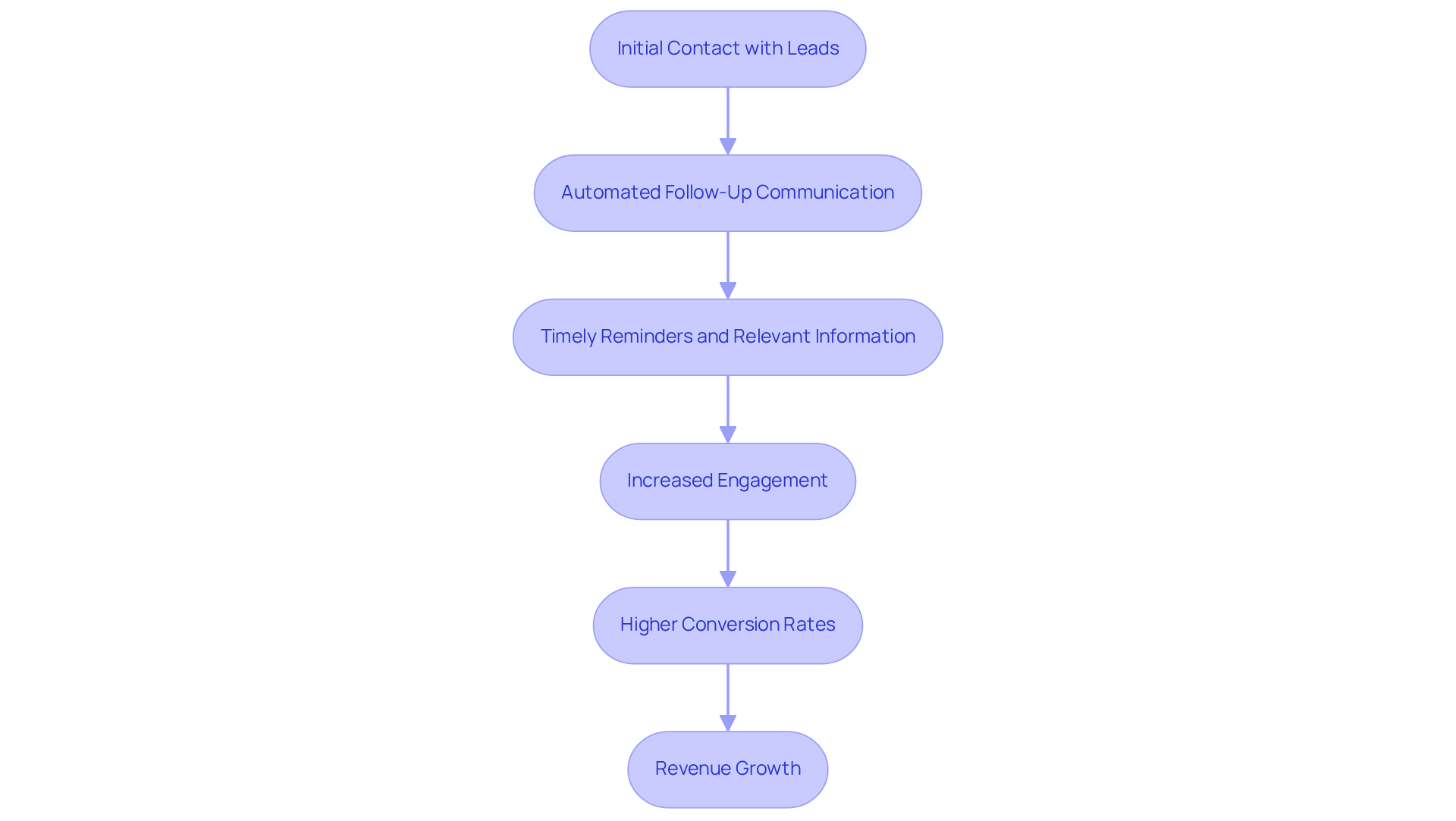

Automated Follow-Ups: Maximize Lead Engagement with AI Telemarketers

The way businesses engage with potential clients is being revolutionized by AI telemarketers. By automating follow-up communications, they ensure that leads receive timely reminders and relevant information after the initial contact. This automation is not just a convenience; it’s essential for maintaining interaction with prospects, significantly increasing the chances of conversion.

Finance managers can strategically plan follow-ups based on lead behavior and preferences, effectively nurturing leads and enhancing overall performance. Intone's AI Voice Agents stand out in this arena, adeptly promoting premium financial plans while enhancing customer education through tailored interactions and informative content delivery. In the competitive fintech landscape, such capabilities are crucial for staying ahead.

Research underscores the impact of AI-driven follow-up automation, with companies reporting conversion rate increases of up to 25%. Furthermore, those leveraging AI-driven marketing tools have seen a 15% rise in revenue, highlighting the efficiency and effectiveness of these technologies. Sales experts emphasize that using Intone's AI tools not only streamlines the follow-up process but also allows teams to focus on high-value interactions, ultimately boosting overall efficiency.

In conclusion, embracing solutions such as Intone's Voice Agents, which function as an AI telemarketer, can transform your approach to client engagement, driving both conversion rates and revenue growth. The time to act is now-leverage these tools to enhance your business performance.

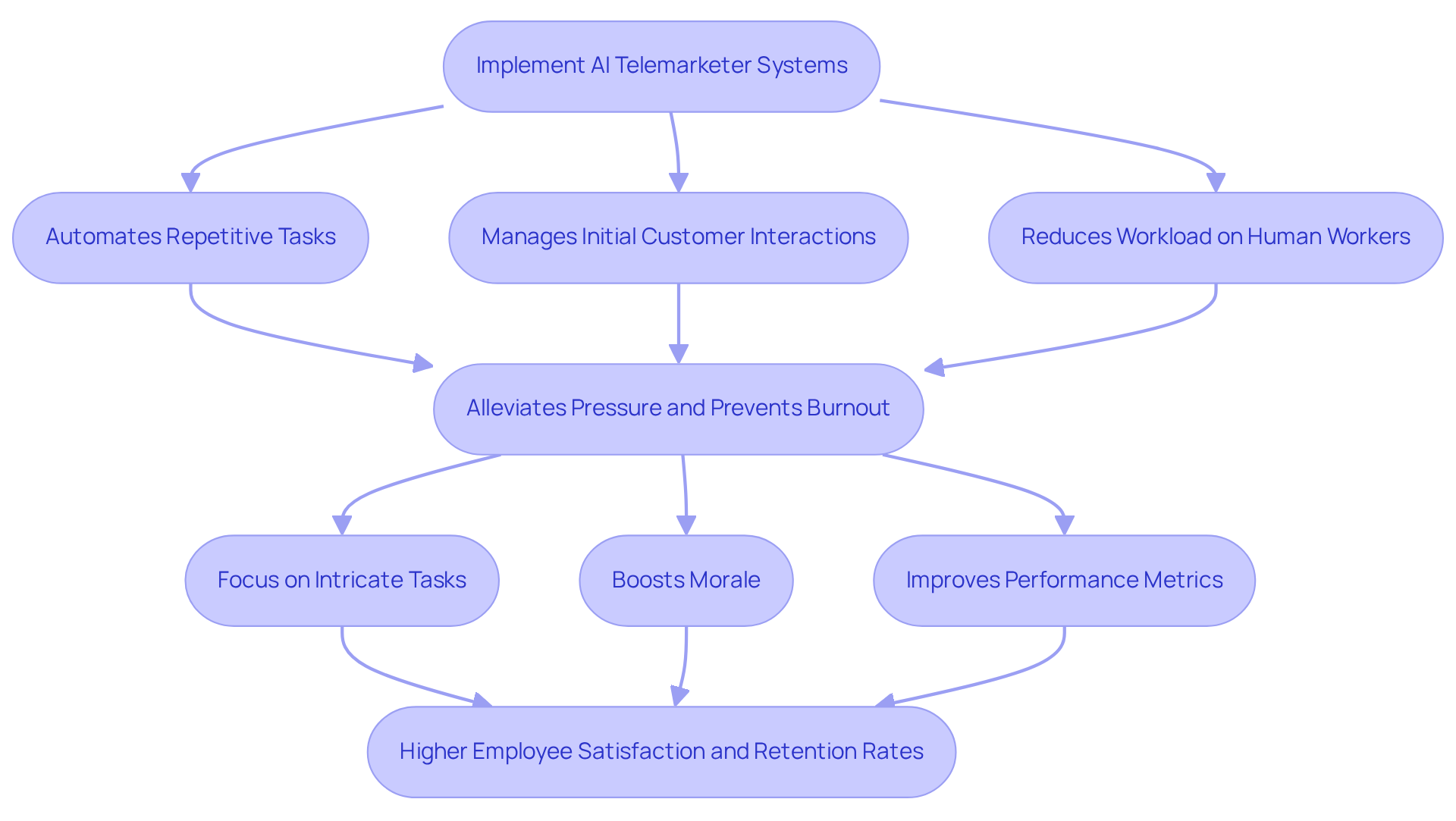

Reduce Agent Burnout: Leverage AI for Efficient Sales Operations

AI telemarketer systems are revolutionizing sales efficiency by automating repetitive tasks and managing initial customer interactions. This automation not only reduces the workload on human workers but also alleviates pressure, helping to prevent burnout. In fact, research shows that over 50% of professionals face daily burnout and emotional fatigue. This highlights the critical role of AI in fostering a sustainable work environment.

As a result, revenue teams can focus on more intricate and fulfilling tasks, which boosts morale and productivity. Organizations that embrace AI solutions report improved performance metrics. For instance, GCS exemplifies this success; by simply communicating their needs, they customized pre-built agents for their calls, leading to significant enhancements in engagement and efficiency.

This thoughtful implementation of AI has transformed GCS's commercial operations, contributing to higher employee satisfaction and retention rates. Companies leveraging AI-powered sales automation tools have experienced marked increases in engagement and efficiency. Clearly, utilizing an AI telemarketer can yield substantial benefits in sales performance, making it an essential strategy for organizations aiming to thrive in today's competitive landscape.

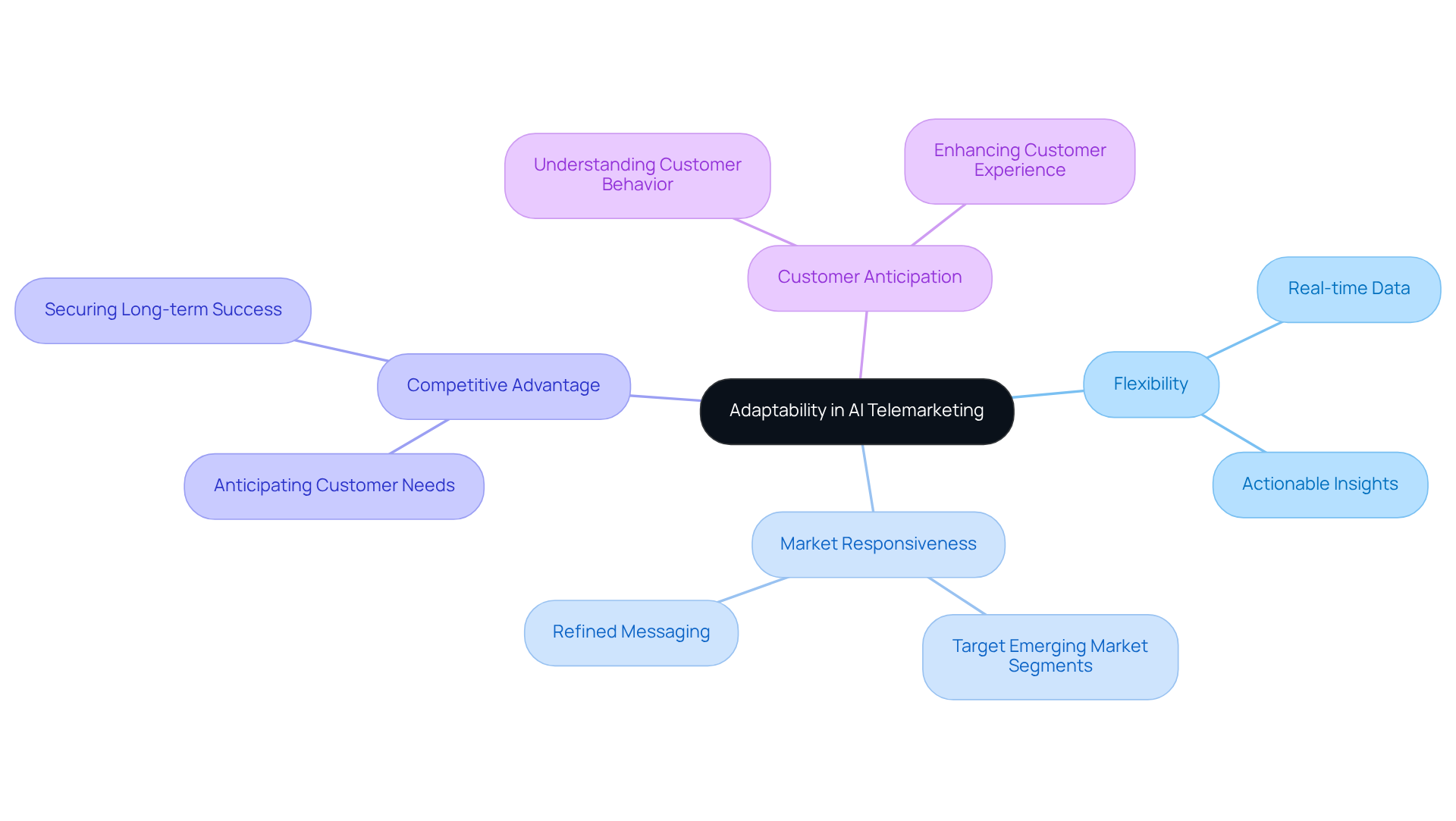

Adaptability: Stay Competitive with AI Telemarketing Solutions

AI telemarketer solutions, such as those offered by Intone, provide remarkable flexibility, enabling managers to swiftly adapt their strategies in response to shifting market dynamics. By harnessing Intone's real-time data and actionable insights, organizations can effectively pivot their approaches, target emerging market segments, and refine their messaging to secure a competitive advantage. This adaptability is essential for maintaining relevance and achieving long-term success in the fast-paced finance landscape.

As Jamie Dimon, CEO of JPMorgan Chase, underscores, integrating AI into management discussions is crucial for gaining a competitive edge. Companies that utilize Intone's AI insights not only respond to market changes but also anticipate customer needs, positioning themselves ahead of competitors in an increasingly data-driven environment. Embracing these insights is not just a strategic move; it’s a necessary step for organizations aiming to thrive in today’s complex market.

Conclusion

Integrating AI telemarketers into finance operations marks a significant shift in enhancing sales efficiency. This automation not only streamlines lead qualification and provides 24/7 customer engagement but also optimizes follow-up processes. As a result, finance managers can dramatically boost their productivity and effectiveness. In a competitive financial landscape, timely and relevant interactions with clients are essential, and AI ensures just that.

The advantages of AI telemarketers are compelling:

- They offer cost savings through reduced operational expenses.

- They foster personalized communication that enhances conversion rates.

- They ensure robust compliance with regulatory standards.

- Furthermore, leveraging real-time analytics empowers finance teams to make informed decisions and adapt strategies swiftly, keeping them responsive to market changes and customer needs.

Ultimately, integrating AI telemarketers transcends mere technological enhancement; it represents a vital strategy for finance professionals aiming to excel in a rapidly evolving market. Embracing these AI-driven solutions not only refines sales processes but also positions organizations as leaders in efficiency and customer engagement. The time to act is now-leveraging AI technology can lead to substantial improvements in sales performance and overall business success.

Frequently Asked Questions

What is the primary function of Intone's AI voice systems in sales?

Intone's AI voice systems automate lead assessment, payment notifications, and client assistance, allowing managers to focus on high-value activities and enhancing sales efficiency.

How do AI telemarketers improve lead qualification?

AI telemarketers utilize sophisticated algorithms to evaluate potential customers' interest and readiness to purchase, scoring leads based on their likelihood to convert, which optimizes the revenue process.

What benefits do companies experience when integrating AI telemarketers?

Companies report significant improvements in lead qualification accuracy and customer satisfaction, as AI telemarketers can handle thousands of conversations simultaneously, far exceeding the capacity of human sales staff.

How much time can financial professionals save by using AI voice systems?

Financial professionals can save up to 30 percent of their time, allowing them to focus on strategic initiatives rather than routine tasks.

What impact does AI have on lead scoring in the finance sector?

Automated lead scoring helps organizations swiftly identify high-intent prospects, significantly improving conversion rates and enhancing operational accuracy.

How do AI voice agents ensure constant customer engagement?

AI voice agents provide 24/7 accessibility, allowing financial managers to connect with potential leads at any time, which captures opportunities that might otherwise be missed.

What percentage of financial institutions utilizing AI report enhanced client experiences?

46% of financial institutions using AI report enhanced client experiences.

Why is 24/7 availability important in the finance sector?

Continuous client support is crucial for success, as it boosts client satisfaction and fosters reliability, which is essential for building trust in the finance sector.